Significant Funding Surge for Startups: $316.1 Million Raised in Just One Week

Between October 4 and 10, startups across various sectors secured approximately $316.1 million in funding. This marks a remarkable increase of around 3.7 times compared to the $86.7 million raised during the same period last year, according to data from Tracxn.

ETtech

This week’s funding tally also represents a 12.1% increase from the $282 million raised in the previous week.

However, despite the significant rise in funding volume, the number of transactions recorded a year-on-year (YoY) decline. This week saw a total of 31 transactions, down from 37 in the same week last year.

ETtech

Top Funding Deals of the Week

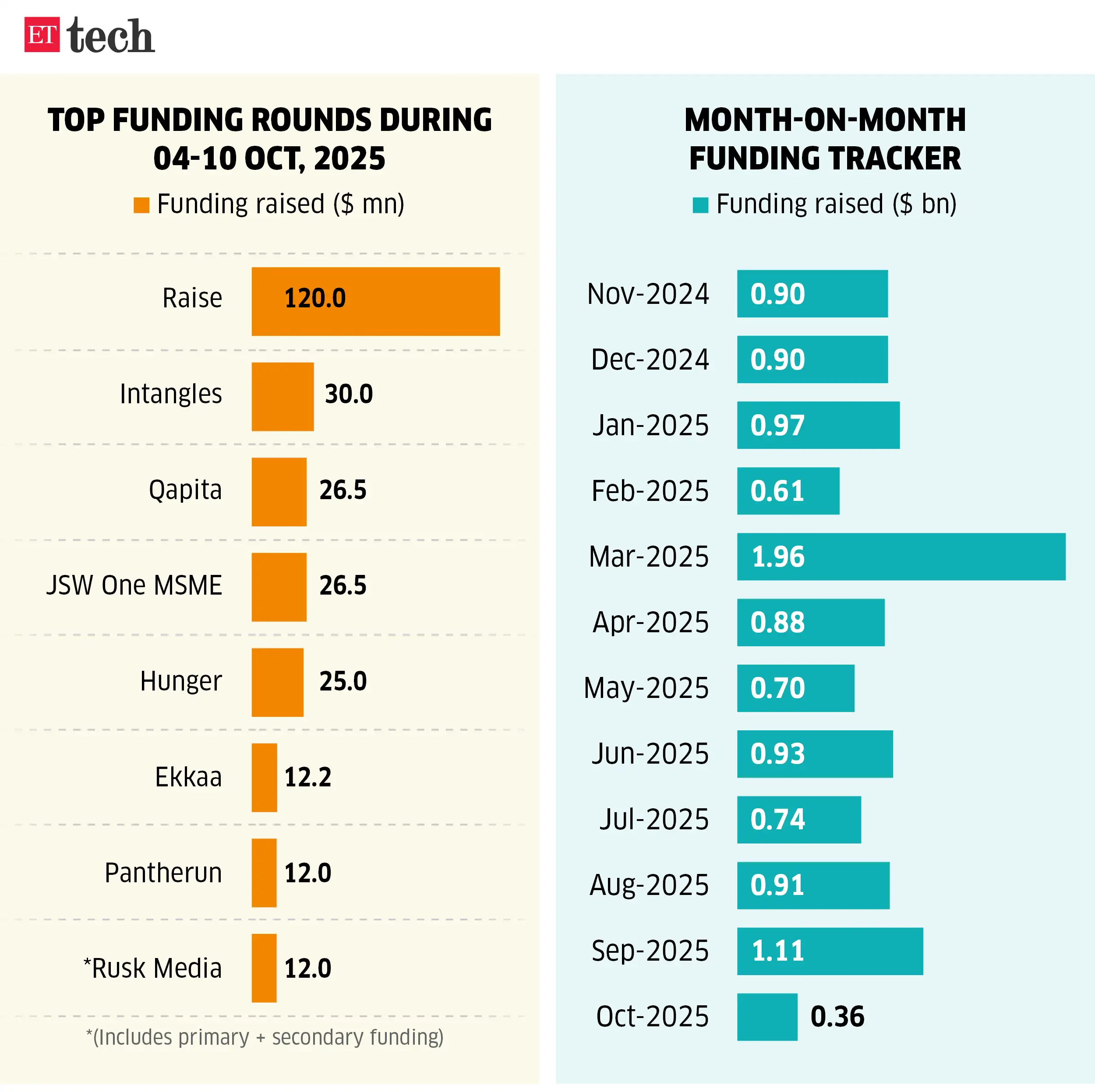

Raise Financial: Leading the charge, Raise Financial, the parent company of stock-trading startup Dhan, closed a whopping $120 million financing round. This investment was spearheaded by Hornbill Capital, bringing the company’s valuation to approximately $1.2 billion. Notable participants in this round included Japan’s Mitsubishi UFJ Financial Group (MUFG), Beenext, and several other investors.

Intangles: The predictive artificial intelligence (AI) platform for automobiles, Intangles, raised $30 million. The funding round was led by Avataar Venture Partners, to which Baring India Private Equity and Cactus Partners contributed.

Qapita: In another significant development, equity management startup Qapita raised $26.5 million in a funding round led by US-based brokerage giant Charles Schwab Corporation.

JSW One Platforms: The B2B ecommerce arm of JSW Group, JSW One Platforms, successfully raised an additional $26.5 million. This funding round included participation from the State Bank of India (SBI), Principal Asset Management, group company JSW Steel, OneUp, International Conveyors, and Scarlett Ventures. The total funding for this round now stands at $64.8 million.

Looking Ahead

As we analyze these trends, it is clear that while the overall funding has surged, the dip in the number of deals may indicate a selective investment climate, where larger rounds are prioritized over smaller transactions.

This shift could reshape strategies for startups in securing investment and planning their growth trajectories.

Conclusion

The recent surge in startup funding highlights both a robust investment climate and the importance of strategic partnerships. With notable funding rounds closing this week, the entrepreneurial landscape continues to evolve rapidly, capturing the interest of prominent investors.

Questions & Answers

- 1. How much funding did startups raise between October 4 and 10, 2025?

- Startups raised approximately $316.1 million during this period.

- 2. What was the increase in funding compared to the same period last year?

- The funding increased by around 3.7 times from $86.7 million raised last year.

- 3. Did the number of transactions increase or decrease compared to last year?

- The number of transactions decreased, with 31 recorded this week compared to 37 the previous year.

- 4. Who led the funding round for Raise Financial?

- Hornbill Capital led the $120 million financing round for Raise Financial.

- 5. What new trend is observed in the startup funding landscape?

- There is a notable shift towards fewer, larger funding rounds, suggesting a more selective investment climate.

This revised text structures the content into a clear, engaging format, enhances readability, and includes informative headings and subheadings. The questions and answers at the end provide a quick reference for key points.