Over the past year, investors have taken a keen interest in companies that can benefit from the proliferation of artificial intelligence (AI). Goldman Sachs expects this technology to help improve the global gross domestic product (GDP) by 7%, or almost $7 trillion, over the next decade.

Companies that are already benefiting from AI adoption have seen their shares surge, but there are a few companies whose share prices are yet to reflect their potential gains from AI proliferation. Two such companies are Taiwan Semiconductor Manufacturing (NYSE: TSM), and SoundHound AI (NASDAQ: SOUN).

TSMC stock has jumped 40% in the past year, underperforming the PHLX Semiconductor Sector index’s gains of 50%. Meanwhile, SoundHound AI stock is down 5% in the past year, despite reporting solid growth thanks to the growing demand for its offerings. Both stocks have gained impressive momentum of late and look all set to go on a bull run.

1. Taiwan Semiconductor Manufacturing

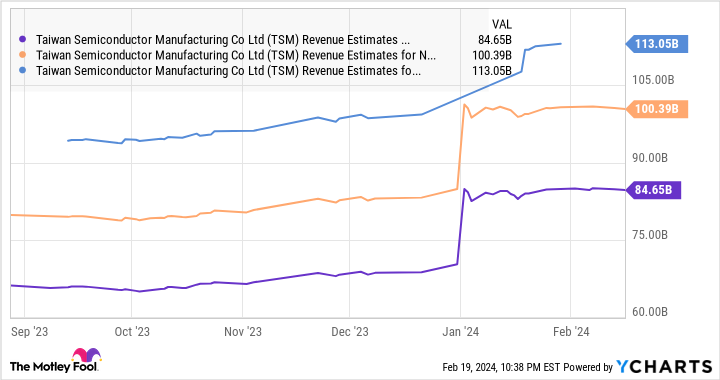

TSMC stock is up 21% so far in 2024, and investors can expect this semiconductor bellwether to head higher thanks to the booming demand for AI chips. TSMC operates on a foundry model, manufacturing chips designed by fabless chipmakers such as Nvidia and Advanced Micro Devices. Apple is TSMC’s largest client, using the Taiwan-based company’s fabrication facilities to manufacture chips for iPhones. Last month, TSMC forecasted that its 2024 revenue could increase more than 20%, and AI is expected to play a crucial role in that growth. Given the demand for AI chips is set to increase at an annual pace of 38% through 2032, TSMC should ideally be able to maintain a healthy growth rate in the long run.

With a trailing earning multiple of 25, investors may want to consider buying TSMC at a discount to the Nasdaq-100 index’s earnings multiple of 32 for tech stocks.

2. SoundHound AI

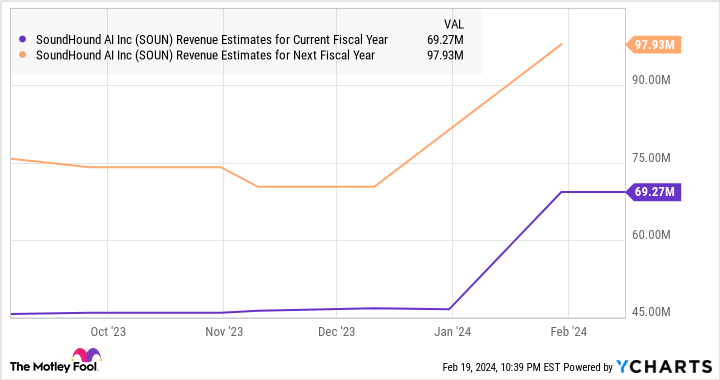

SoundHound AI has seen a surge in share prices after chip giant Nvidia revealed in a 13F filing that it has invested $3.7 million in the company. The stock now trades at 21 times sales, but this valuation could be justified by its robust growth. SoundHound’s strong revenue pipeline should allow it to maintain healthy growth rates not only in 2024 and 2025 but also over the long run.

Investors considering SoundHound may want to act fast before its stock soars higher, especially considering the company’s robust growth could help support its impressive stock market rally.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the

10 best stocks

for investors to buy now… and SoundHound AI wasn’t one of them. See the 10 stocks.

*Stock Advisor returns as of February 20, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Goldman Sachs Group, Nvidia, and Taiwan Semiconductor Manufacturing.

The Motley Fool has a disclosure policy.

2 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run was originally published by The Motley Fool

2-top-artificial-intelligence-ai-stocks-ready-for-a-bull-run