Investing in the stock market can be a lucrative way to grow your wealth over time. One proven strategy is to buy and hold great companies for the long run, allowing you to benefit from both secular growth opportunities and the power of compounding. One sector that has emerged as a hot growth opportunity in recent years is artificial intelligence (AI).

According to Bloomberg, the generative AI market was worth $40 billion in 2022 and is projected to reach $1.3 trillion in annual revenue by 2032, with a compound annual growth rate of 42%. This staggering growth potential has caught the attention of investors looking to capitalize on the AI revolution.

One company that has been at the forefront of AI hardware is Nvidia. An investment of $10,000 in Nvidia a decade ago is now worth $1.68 million, showcasing the potential for substantial gains by investing in AI-related stocks. While replicating Nvidia’s success may be unrealistic, there are other opportunities in the AI space that investors can explore.

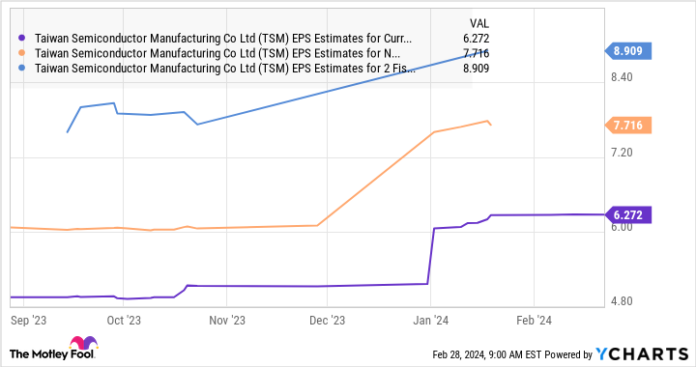

Two such companies are Taiwan Semiconductor Manufacturing (TSMC) and Super Micro Computer. TSMC is the world’s leading foundry, with a market share of 58%, making it a key player in the semiconductor industry. The demand for semiconductors, driven by AI applications, is expected to soar in the coming years, presenting a significant growth opportunity for TSMC.

On the other hand, Super Micro Computer has seen its stock triple in 2024 as AI adoption has boosted its growth. The company is anticipating a sharp increase in revenue, driven by the expansion of the global AI server market. With its server solutions being deployed for AI chips, Super Micro is well-positioned to capitalize on the growing demand for AI-related technologies.

Investing $10,000 in TSMC and Super Micro could be a smart long-term move for investors looking to build a million-dollar portfolio. Both companies are poised to benefit from the AI market’s growth, setting the stage for substantial gains over the years.

While past performance is not indicative of future results, the potential upside for TSMC and Super Micro is promising. By holding onto these stocks for the long run, investors could see significant returns and contribute to a successful investment portfolio. As always, it’s essential to conduct thorough research and consult with a financial advisor before making any investment decisions to ensure they align with your financial goals and risk tolerance.