Artificial intelligence (AI) enthusiasm sparked a new bull market in 2022 after hitting rock bottom in the fall of that year. Some of the biggest names on Wall Street have seen their value multiply, with shares trading as high as $1,000 today.

Investors may be interested in hunting for potential stock splits as a result. Stock splits are generally favored by investors because they make acquiring shares of a company more manageable. However, it’s crucial to understand what a split does and doesn’t do.

Here’s what you need to know. Plus, here are three prime AI stock-split candidates to keep an eye on.

What stock splits do — and don’t do

A stock split decreases a company’s share price by increasing the number of outstanding shares proportionally. For example, if stock XYZ is trading at $100 per share, a 5:1 split would result in each $100 share becoming five $20 shares.

Companies opt for stock splits for various reasons, but typically because they believe investors prefer lower share prices. It can overcome some investors’ reluctance to buy shares above a certain price threshold. A split can also garner attention from investors and make it easier for employees with stock-based compensation to manage their equity. Furthermore, employers find it simpler to offer stock-based compensation when share prices are lower. It’s easier to distribute 100 pennies than a single dollar bill.

Remember, a stock split doesn’t alter the intrinsic value of the business. The additional shares offset the lower price. Essentially, cutting a pie into more slices doesn’t change the overall size of the pie.

So, which companies might be next in line to split their stocks? These three AI companies have had significant growth and are strong contenders for a split.

1. Super Micro Computer

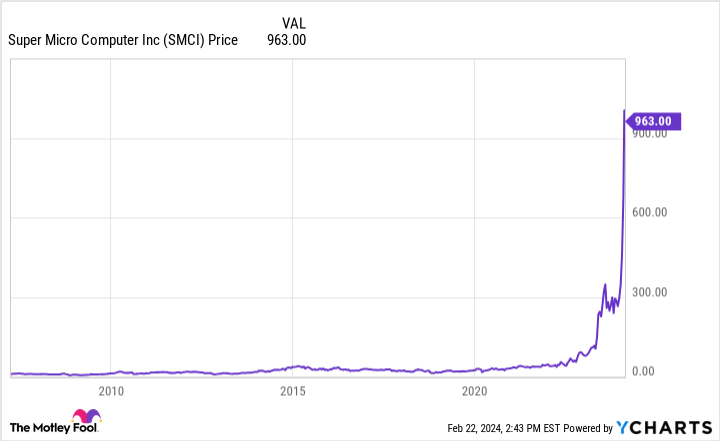

The modular server company Super Micro Computer (NASDAQ: SMCI) has experienced tremendous success in recent quarters. With rising interest in AI, companies are turning to SMCI’s computing systems. Revenue more than doubled year over year in the second quarter of fiscal year 2024, with management forecasting up to 219% growth next quarter.

Supermicro, as it’s also known, has never split its stock since going public in 2007. However, the stock’s exceptional performance has pushed shares close to $1,000, reflecting a nearly 3,000% increase over the past three years.

The company has awarded stock-based compensation over the years, and employees with old equity may welcome a stock split to manage their wealth. Moreover, individual investors who may be hesitant to spend $1,000 on a single share of the company could benefit from a stock split.

2. ASML

Manufacturer of photolithography equipment, ASML (NASDAQ: ASML), has enjoyed significant growth in recent years. The company designs and sells equipment using ultraviolet light to print complex circuitry on silicon wafers. ASML is the sole producer of specialized extreme ultraviolet light machines essential for the most advanced semiconductors powering AI models.

ASML has undergone multiple stock splits before, demonstrating management’s willingness to do so. However, it’s been some time since the last split occurred before 2015, and the stock has surged since then.

Analysts anticipate 20% annual earnings growth for ASML over the next three to five years. Unless the stock’s valuation suddenly drops, ASML could potentially reach over $1,000 per share. With most U.S. exchange-listed stocks trading below $1,000 per share, a stock split could be on the horizon in the coming years.

3. Meta Platforms

The social media behemoth and AI trailblazer Meta Platforms (NASDAQ: META) appeared an unlikely candidate for a stock split a year ago. Facing challenges from iOS device privacy changes and criticism for aggressive spending, the stock hit a low of around $90 per share in late 2022.

However, CEO Mark Zuckerberg responded by implementing spending cuts and introducing new AI-based advertising technology that propelled the stock to nearly $500. Although Meta Platforms has never split its stock, going public in 2012, the conversation around a potential split is more pertinent than ever with shares at all-time highs.

Meta’s primary operations, expanding its social media audience and advertising, continue to perform strongly. The company’s app family has reached 3.98 billion monthly active users in 2023, a 6% rise from the previous year. Analysts foresee Meta’s earnings growing at a 20% annual rate for the next several years, increasing the likelihood of a potential stock split.

Should you invest $1,000 in Super Micro Computer right now?

Before investing in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy now… and Super Micro Computer didn’t make the list. The identified stocks could yield significant returns in the coming years.

Stock Advisor offers investors a comprehensive plan for success, featuring portfolio building guidance, regular analyst updates, and two new stock picks per month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than threefold*.

*Stock Advisor returns as of February 20, 2024

Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope holds no position in any of the mentioned stocks. The Motley Fool holds positions in and recommends ASML and Meta Platforms. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

3 Artificial Intelligence (AI) Stocks Just Begging for a Stock-Split was originally published by The Motley Fool

3-artificial-intelligence-ai-stocks-just-begging-for-a-stock-split