Technology giant Nvidia is hitting new heights thanks to demand for products connected to artificial intelligence, leading the chip maker to a market value that this week approached that of the entire Canadian economy.

The California-based company briefly hit $2 trillion US in overall value, or market capitalization, for the first time on Friday, riding on insatiable demand for its semiconductors and chips.

The entire Canadian economy, as measured by GDP, was $2.12 trillion US in 2023 according to the International Monetary Fund.

Less than a year ago, Nvidia was worth about $1 trillion US. Its growth over the past eight months has been characterized as the fastest among U.S. companies. Nvidia went from $1 trillion to $2 trillion in value in less than half the time it took tech giants Apple and Microsoft.

The milestone followed another bumper revenue forecast that drove up its market value by $277 billion US on Thursday — Wall Street’s largest one-day gain on record.

By Friday, Nvidia’s market capitalization (its total value on the stock market) was higher than Amazon or Google’s parent company Alphabet.

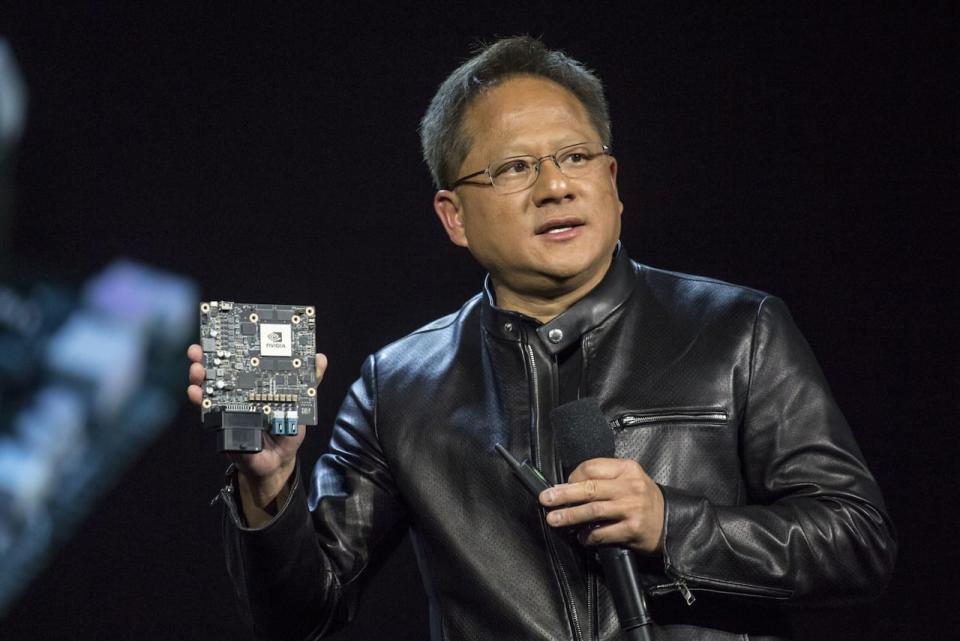

“Demand is surging worldwide across companies, industries and nations,” founder and CEO Jensen Huang wrote in a statement with the company’s latest financial results.

The Nintendo Switch uses some Nvidia components. The California-based company made its name with graphics cards used to drive video games on personal computers. (Timothy A. Clary/AFP/Getty Images)

From video games to AI

It’s a big shift for a company that has become one of the biggest players in AI after building its initial name by creating graphics chips used to drive video games on personal computers and devices such as the Nintendo Switch.

“I’ve never seen anything quite like this,” said analyst Stacy Rasgon, who focuses on semiconductors for Bernstein Research.

Rasgon is among many industry analysts pointing out that Nvidia’s previous bread and butter turned out to be well suited for generative artificial intelligence and its associated technologies.

“It became clear that you could use these things to do machine learning and everything kind of snowballed from there,” said Rasgon.

“Researchers discovered that the graphics chips that Nvidia was developing… lent themselves very well to running AI algorithms,” said Emil Savov, managing director of Ontario’s MaRS Investment Accelerator Fund.

Few competitors

For now, stock market analysts say Nvidia does not have competitors who can match its production of products to support AI.

“Nvidia has, I think, an 80 per cent market share, really no competition at the moment. And the company [has predicted] really tremendous growth from AI workflows going forward. And they think we’re just getting started,” said Barry Schwartz, with Baskin Wealth Management in Toronto.

Schwartz has said that while many tech companies are moving into AI, one of the only outfits that can supply the actual hardware to power all those calculations is Nvidia.

And yet many of those companies are working to wean themselves off Nvidia, according to industry watchers such as Emil Savov.

Emil Savov, managing director of the MaRS Investment Accelerator Fund in Ontario. says Nvidia had a ‘head start’ on AI technology thanks to its graphics cards. (Submitted by MaRS Investment Accelerator Fund)

‘Very long and very robust’

With competitors ramping up their own production, and high stock prices indicating investor interest in artificial intelligence, the market for artificial intelligence chips may stay red hot.

“I still think in five years or ten years, we will be talking about numbers that are materially higher than what we’re talking about today,” predicted semiconductor analyst Stacy Rasgon.

While Rasgon is predicting a “very long and very robust” upward trend for semiconductor and computer chip manufacturers such as Nvidia, he pointed out that even the company itself says supply chain and manufacturing bottlenecks could be a problem.

“Demand is still vastly exceeding their ability to supply,” said Rasgon.

Ups and downs aren’t new for companies such as Nvidia. Its graphics cards were hard to find back in 2022 amid an industry-wide shortage, for instance. Demand was high, in part, due to buyers using the cards for mining cryptocurrencies.

But computer science expert Gennady Pekhimenko says he does not expect the interest in Nvidia’s technology to follow the eventual bust of the crypto boom.

“The fundamental difference here, not just [for] Nvidia alone, is the use case,” said Pekhimenko, who is an associate professor of computer science at the University of Toronto.

Pekhimenko says that when so many technologies are using AI, the demand for the hardware to power it will be even higher and that multiple companies, not just Nvidia, will be working to supply.

“We use it on our phones already. We use it in the cloud. We use things like ChatGPT. We use facial recognition features in our phones,” said Pekhimenko, who is also co-founder of CentML, a company that has received investment from Nvidia and develops products that optimize machine learning technology.

“I see how humongous the demand is for it… [Nvidia] are operating at the limit of what they can manufacture really. And I think they will manufacture more,” he said.

thanks-to-ai-and-its-head-start-making-graphics-cards-nvidias-value-has-already-hit-2t