Nvidia (NASDAQ: NVDA) stock has surged by more than 435% since the start of 2023 as businesses turn to the tech giant for its high-performing suite of artificial intelligence (AI) chips. Its financial performance has been exceptional, with both revenue and net income experiencing triple-digit growth rates quarter after quarter. In the fourth quarter of fiscal 2024, revenue reached a record high of $22.1 billion, while net income rose to $12.3 billion.

Despite these positive developments, investors have expressed concerns about competition. Nvidia is facing challenges from other chip designers like Advanced Micro Devices and even some of its partners such as Amazon Web Services (AWS). However, before worrying too much about competitors overtaking this market leader, it’s crucial to examine one specific number that could secure Nvidia’s dominance in the AI chip sector in the future.

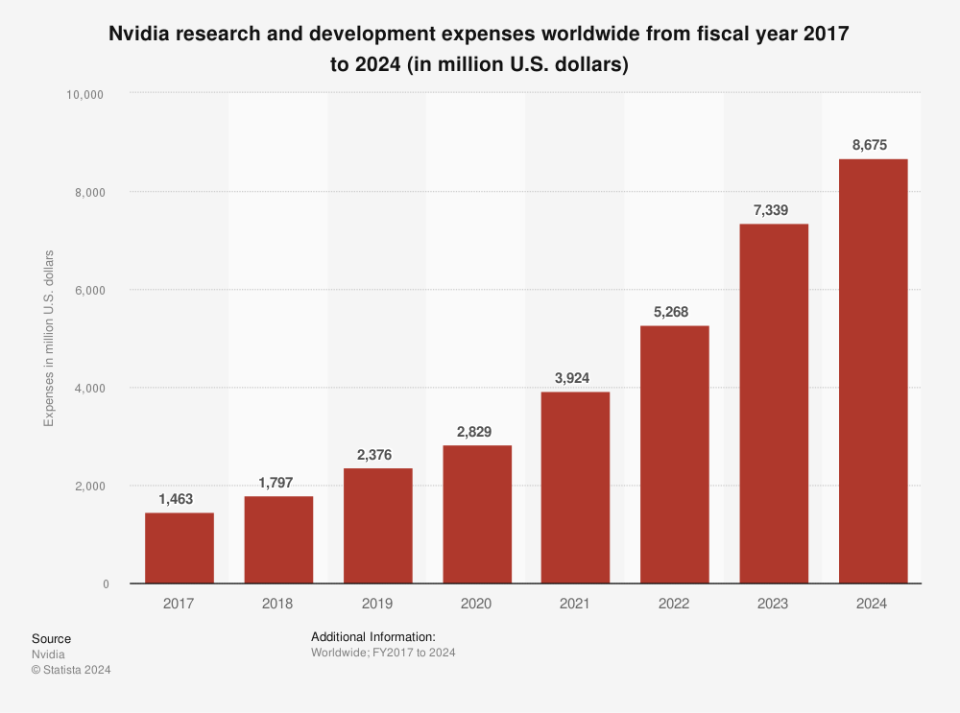

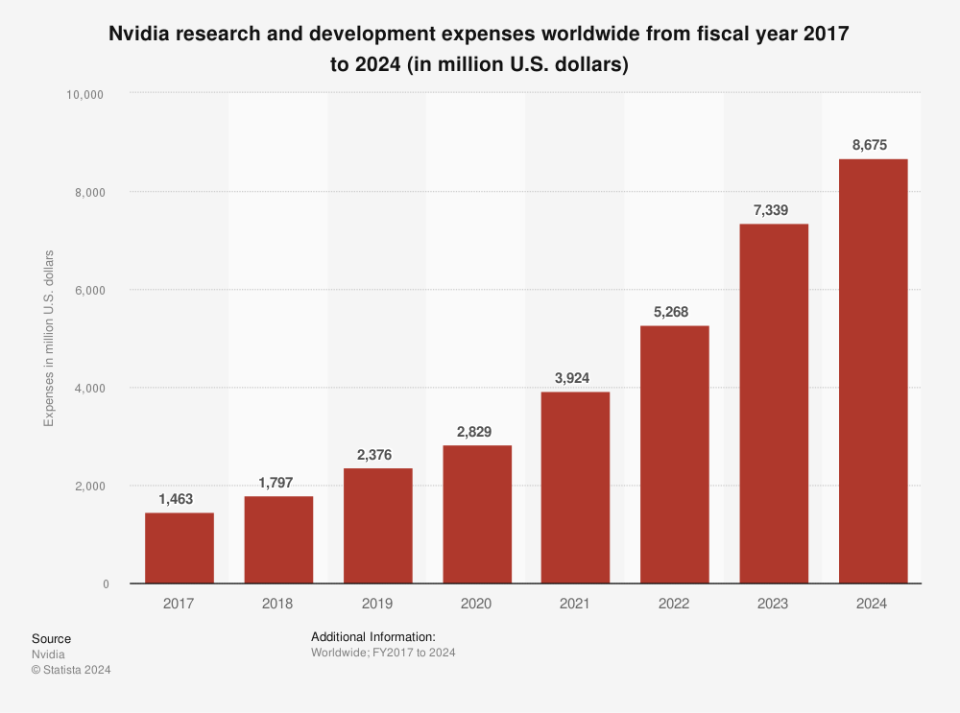

The key factor to consider is research and development (R&D) spending. Nvidia’s R&D expenses have steadily increased over the years, reaching $8.7 billion in fiscal 2024. This represents a nearly 500% rise in just seven years, indicating Nvidia’s strong focus on driving innovation during that period.

Nvidia’s 80% market share

Currently, Nvidia commands over 80% of the AI chip market, giving the company a significant edge. Despite this, competitors are striving to erode Nvidia’s lead.

For instance, AMD introduced a high-performance chip late last year, albeit slower than Nvidia’s top product, enticing budget-conscious customers. AWS is also targeting cost-conscious customers with its range of chips for language model training and inference. These are just a couple of examples.

Therefore, it’s essential for Nvidia to continue investing in R&D to maintain its innovation momentum and safeguard its market-leading position. This strategy affords the company pricing power and should ensure its AI chip dominance in the long run.

Through its ongoing efforts and strong earnings history, Nvidia remains a great growth stock to consider investing in today.

Should you invest $1,000 in Nvidia right now?

Prior to purchasing Nvidia stock, it’s important to note:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in now… and Nvidia did not make the list. The 10 selected stocks have the potential to generate substantial returns in the years to come.

Stock Advisor offers investors a straightforward roadmap to success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than triple the return*.

*Stock Advisor returns as of February 20, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino holds positions in Amazon. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, and Nvidia. The Motley Fool has a disclosure policy.

This 1 Number May Ensure Nvidia’s Artificial Intelligence (AI) Chip Dominance was originally published by The Motley Fool

this-1-number-may-ensure-nvidias-artificial-intelligence-ai-chip-dominance