Salesforce (NYSE: CRM) was founded in 1999, and the software company went public in 2004. Since then, the stock has soared by 6,730%, solidifying Salesforce as a leader in customer relationship management (CRM) software and the second-largest enterprise software company globally.

Innovation has played a key role in Salesforce’s success. Being one of the first movers in cloud-based software delivery, coupled with continuous product development, has kept Salesforce at the forefront of CRM technology. Recent efforts have focused on data analytics and artificial intelligence (AI), which could further drive the stock price upward in the future.

Here’s what investors should take note of.

Salesforce shows profitable growth in its fiscal third quarter

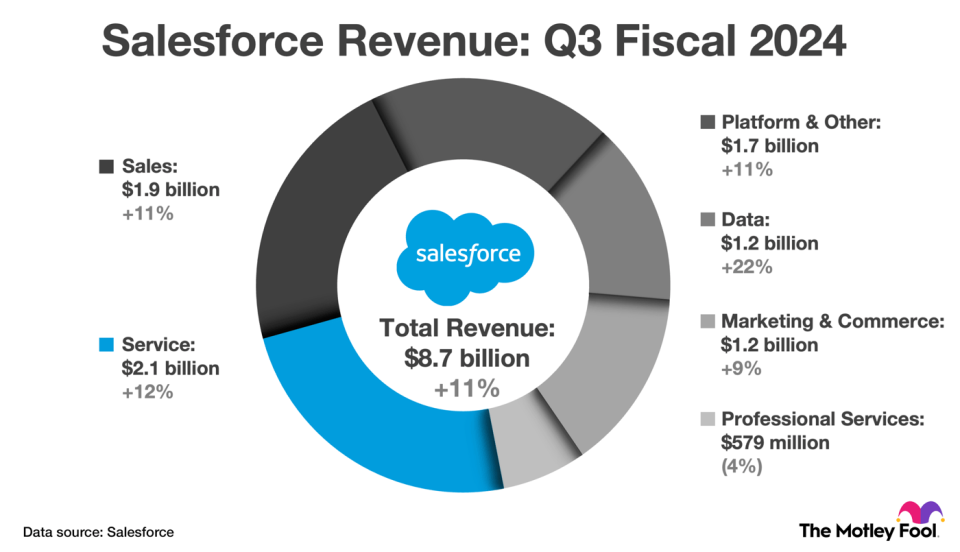

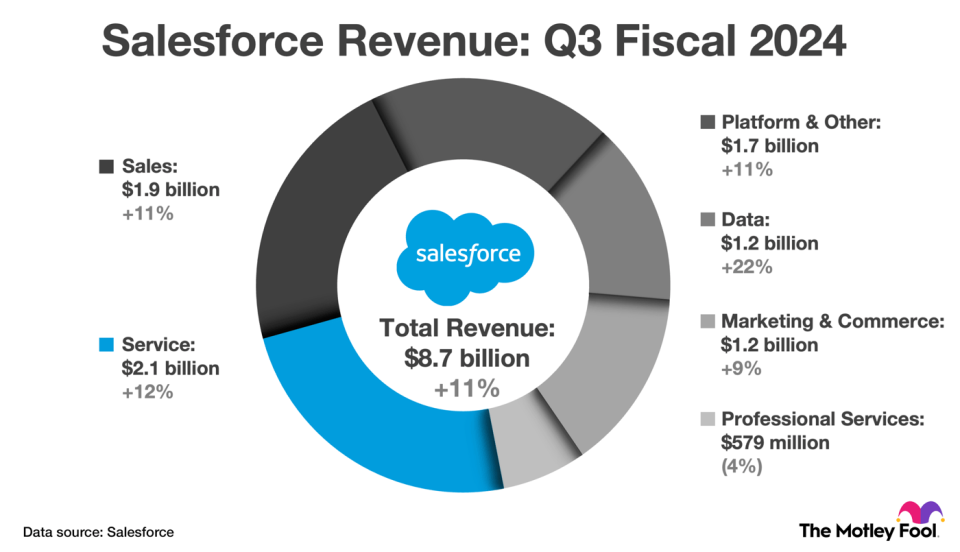

In its fiscal Q3 2024, Salesforce reported strong results with revenue climbing by 11% to $8.7 billion, led by robust performance in the data cloud segment. Additionally, non-GAAP net income surged by 51% to $2.11 per diluted share, reflecting disciplined cost management and an expansion in operating margin.

The chart below illustrates revenue growth in Salesforce’s five subscription software segments, a significant portion of its total revenue.

Salesforce is well-positioned for business growth, boasting a 22% market share in CRM software, surpassing the combined market share of its top four competitors. Industry analysts have also recognized Salesforce’s top-notch products across various sectors. Notably, Gartner has acknowledged Salesforce’s leadership in multiple software categories over the past year.

More importantly, research firm G2 ranked Salesforce as the premier software vendor in 2024, citing high customer satisfaction and market presence. These accolades affirm Salesforce’s strong software offerings, appealing not just to investors but also potential customers.

Product innovation to fuel revenue growth

With strong demand for data analytics and AI tools, Salesforce stands to capitalize on these trends. A Morgan Stanley survey identified data analytics and AI as top IT spending priorities in 2024, with Salesforce being a strong contender to gain share in IT budgets alongside Microsoft and Amazon.

Einstein Copilot, Salesforce’s generative AI assistant, is now available, offering automated workflows across CRM applications. This tool is expected to drive revenue growth as businesses increasingly adopt AI for enhanced productivity and operational efficiency.

Furthermore, Salesforce offers industry-specific CRM solutions for sectors like consumer goods, healthcare, manufacturing, and retail, enhancing customer acquisition. Many of these tailored CRM platforms experienced robust revenue growth in Q3 2024, signaling sustained positive results.

Salesforce stock valuation and outlook

Analysts forecast Salesforce’s revenue to grow at a 12% annualized rate over the next five years, fueled by the expanding CRM market at a projected 14% annualized growth rate through 2030. Salesforce’s dominance in CRM positions it for steady revenue growth in the low teen percentages.

With new products in data management and AI, Salesforce could potentially surpass expectations, aiming for mid-teens percentage revenue growth by 2030. At a current valuation of 8.5 times sales, the stock appears reasonably priced despite a slight premium compared to its three-year average of 7.5 times sales.

Investors may find a buying opportunity in Salesforce’s undervalued stock, poised to outperform the CRM market. While not a speculative play for astronomical returns, Salesforce presents a solid option to beat the market over the next five years. Patient investors looking for exposure to AI stocks should consider a small position in Salesforce, part of a diversified investment portfolio.

Should you invest $1,000 in Salesforce right now?

Before investing in Salesforce, consider:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to buy now, excluding Salesforce. These selected stocks have the potential for significant returns in the future.

Stock Advisor provides investors with expert guidance on building portfolios, regular analyst updates, and two new stock picks monthly. Since 2002, the service has outperformed the S&P 500 by over triple the returns.

*Stock Advisor returns as of February 26, 2024

John Mackey, former CEO of Whole Foods Market and an Amazon subsidiary, is a board member of The Motley Fool. Trevor Jennewine has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Microsoft, and Salesforce. The Motley Fool recommends Gartner and options trading. See The Motley Fool’s disclosure policy.

1 Artificial Intelligence (AI) Growth Stock Up 6,730% Over 20 Years to Buy Now and Hold Long Term was originally published by The Motley Fool

1-artificial-intelligence-ai-growth-stock-up-6730-over-20-years-to-buy-now-and-hold-long-term