The artificial intelligence (AI) market exploded last year, with excitement over the industry being a leading contributor to the Nasdaq Composite‘s 33% rise since last February.

Dozens of tech companies enjoyed soaring stock prices. Chipmaker Nvidia arguably benefited most from increased interest in AI as its stock has risen 230% over the last year. The company has rallied investors by snapping up an estimated 80% to 95% market share in graphics processing units (GPUs), the chips necessary for training AI models. Nvidia has experienced skyrocketing earnings thanks to a spike in AI GPU sales.

Nvidia is an attractive way to invest in AI. However, it’s worth considering investing in its rivals, such as Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC). These companies are at earlier stages in their AI journeys and could have more room to run over the long term. Meanwhile, both chipmakers have unveiled competing AI GPUs that could challenge Nvidia’s hardware.

So, the question is whether AMD or Intel is better equipped to go head-to-head with Nvidia in the AI chip market and steal a portion of its market share.

Advanced Micro Devices

Shares of AMD are up 117% in the last 12 months, rallying Wall Street with its growing prospects in AI. The company is easily Nvidia’s biggest rival, nipping at its heels for years with the second-largest share of the GPU market.

AMD wasn’t as well equipped as Nvidia in 2023 to immediately begin supplying its chips to the swarm of AI developers requiring high computing power. However, the chip designer unveiled a new AI GPU last December that could see it attain a lucrative role in the industry.

The company’s MI300X AI GPU is expected to be highly competitive with similar offerings from Nvidia and has already caught the attention of some of AI’s biggest players. In November 2023, Microsoft announced Azure would become the first cloud platform to implement AMD’s new GPU to optimize its AI capabilities. Microsoft has a close partnership with ChatGPT developer OpenAI, making the company a powerful ally for AMD.

AMD released its fourth-quarter 2023 earnings on Jan. 30. The company’s revenue rose 10% year over year to $6 billion in the quarter, beating analysts’ forecasts by $60 million. Solid growth came from its AI-focused data center segment, which posted revenue growth of 38%.

AMD could be on the brink of a stellar growth year as it begins shipping the MI300X and sees returns on its considerable investment in AI.

Intel

Last December, Intel unveiled a range of AI chips, including Gaudi3, a GPU designed to challenge Nvidia’s and AMD’s hardware. Meanwhile, Intel showcased new Core Ultra processors and Xeon server chips, both of which include neural processing units for running AI programs more efficiently.

However, the company has hit some roadblocks since then. Intel’s stock declined 12% since Jan. 25, when it released its fourth-quarter 2023 earnings results. The tech giant posted revenue growth of 10% year over year, beating Wall Street estimates by $230 million as it benefited from an improving PC market.

However, that wasn’t enough to overshadow weak guidance that sent Intel’s stock tumbling. The company expects its first-quarter 2024 earnings to come in at $0.13 per share; analysts had forecast $0.42 per share.

A shift in the chip market has seen demand for central processing units (CPUs) dwindle while GPU sales have soared. As a leader in CPUs, Intel’s business has suffered, with its free cash flow currently sitting at a negative $14 billion.

Intel has a promising long-term outlook in AI, but it will take time for the company to transition its business to GPUs.

Is AMD or Intel the better AI stock?

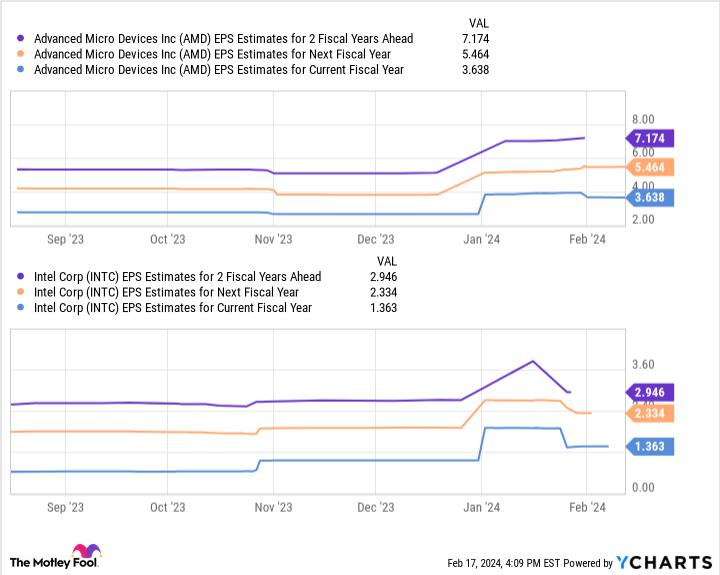

AMD’s forward price-to-earnings (P/E) ratio of about 48 compared to Intel’s 32 means its stock offers far less value.

Forward P/E is a helpful valuation metric calculated by dividing a company’s current share price by its estimated future earnings per share. And the lower the figure, the better the value.

Additionally, this chart shows AMD’s earnings could hit about $7 per share, while Intel’s may reach just under $3 per share over the next two fiscal years. Multiplying these figures by the companies’ forward P/Es yields stock prices of $336 for AMD and $96 for Intel.

Considering their current positions, these projections would see AMD’s stock rise 94% and Intel’s 118% by fiscal 2026. On this basis alone, Intel looks like the better AI stock. Intel offers more value and potentially has more room for growth in the near term.

However, AMD’s more established position in the AI GPU market and free cash flow of $1 billion compared to Intel’s negative $14 billion suggest that AMD is a more reliable investment.

AMD is the financially healthier business and could be less risky if you’re willing to pay its premium price tag.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Advanced Micro Devices made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 20, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short February 2024 $47 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock: AMD vs. Intel was originally published by The Motley Fool

better-artificial-intelligence-ai-stock-amd-vs-intel