Two of the biggest names in artificial intelligence (AI) recently are Arm Holdings (NASDAQ: ARM) and Nvidia (NASDAQ: NVDA). Arm Holdings has seen a 70% increase in shares this year, while Nvidia had an exceptional 2023 with a 239% increase in value, making it one of the most valuable companies globally. For investors looking to capitalize on AI growth opportunities, it may seem like the best players are already fully invested.

Arm and Nvidia are expected to continue growing, but investors may be hesitant to buy at their current valuations. Fortunately, not all AI stocks are trading at a significant premium. One that appears relatively undervalued is Taiwan Semiconductor Manufacturing (NYSE: TSM), known as TSMC.

Is TSMC an underrated AI investment?

TSMC is the leading third-party semiconductor foundry globally, poised to benefit from increased chip demand. The company anticipates over 20% growth in revenue this year due to robust demand for high-end chips. CEO C.C. Wei believes that TSMC will play a crucial role in the future of AI: “We are a key enabler for AI applications. So far today, everything you saw for AI comes from TSMC.”

TSMC’s projected revenue growth is promising, especially as the company faces challenges from a slowdown in consumer electronics demand. AI could serve as a significant growth catalyst for TSMC. While the revenue for Q4 2023 decreased by 1.5% year over year, on a quarter-over-quarter basis, revenue and profits were up by 14% and 13%, respectively, indicating a stronger trajectory for the company.

TSMC’s stock offers an attractive valuation

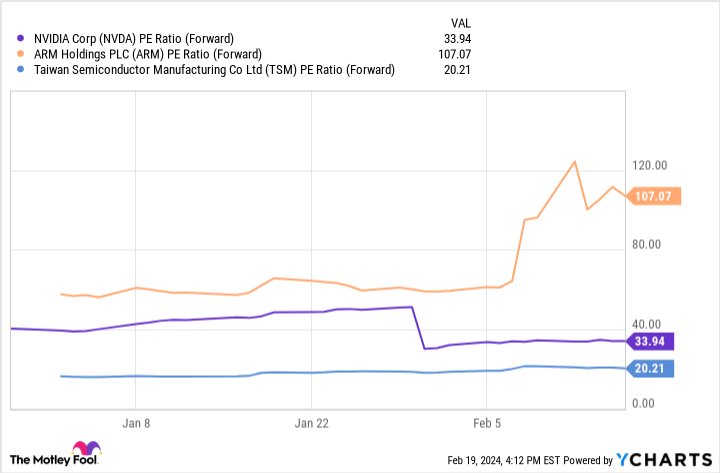

With a forward price-to-earnings multiple of only 20 based on analysts’ future profit expectations, TSMC’s stock appears relatively inexpensive compared to Nvidia and Arm.

However, there are a couple of reasons why investors may have opted for Nvidia or Arm over TSMC. Firstly, TSMC is headquartered in Taiwan, posing geopolitical risks that may deter investors despite the company’s potential. Secondly, TSMC recently delayed the timelines for its new factories in Arizona, a $40 billion investment. The delays, attributed to a lack of skilled workers, may have discouraged investors from investing in TSMC stock at this time.

Should you consider investing in Taiwan Semiconductor Manufacturing?

Whether you’re a tech sector enthusiast or bullish on AI stocks, TSMC presents a compelling investment opportunity in technology. Despite challenges from slowing consumer demand, TSMC’s long-term prospects remain strong. The company stands to benefit from escalating AI demand and a potential rebound in consumer electronics demand. In the long run, TSMC could join the $1 trillion market cap club, alongside Nvidia and others.

With a relatively modest valuation, TSMC could be one of the better AI stocks to consider purchasing now.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Prior to investing in Taiwan Semiconductor Manufacturing, consider:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now. Taiwan Semiconductor Manufacturing did not make the list. The 10 selected stocks have the potential to generate substantial returns in the coming years.

Stock Advisor offers investors a straightforward path to success with portfolio building tips, analyst updates, and two new stock picks every month. Since 2002, the Stock Advisor service has surpassed the returns of the S&P 500 by more than threefold.

*Stock Advisor returns as of February 20, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Missed Out on Nvidia and Arm? This AI Stock Still Looks Cheap was originally published by The Motley Fool

missed-out-on-nvidia-and-arm-this-ai-stock-still-looks-cheap