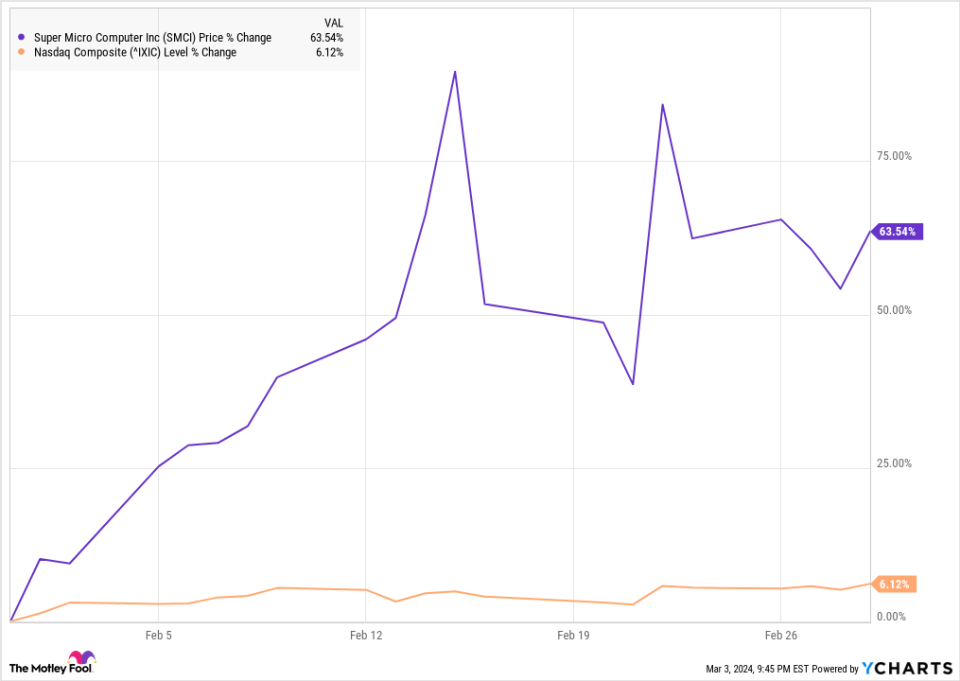

Super Micro Computer (NASDAQ: SMCI) was a big winner last month. The maker of storage and server systems that are highly valued for artificial-intelligence applications continued to climb after reporting a blowout earnings report late January and benefited from strong quarterly results from Nvidia, a key supplier. According to data from S&P Global Market Intelligence, the stock gained 63% in February.

Like Nvidia, Supermicro has emerged as something of a bellwether in the AI stock sector, and the stock has been highly volatile, swinging in response to broader sentiment on AI stocks.

The AI boom is still heating up

It’s unusual to see a stock soar this much in a single month without any major company-specific news, but Supermicro’s gains show how much it’s benefiting from excitement over AI.

Like Nvidia, Supermicro is seeing its revenue growth soar. Sales were up 103% in its quarterly report, released at the end of January, and investors see it as a big winner in the AI boom.

In addition to momentum from that earnings report, the stock benefited from a bullish note from Goldman Sachs on Nvidia, citing robust demand for AI servers. That pushed Supermicro stock up 14% on Feb. 5. At the end of that week, on Feb. 9, the stock jumped after Arm Holdings delivered a blowout earnings report, citing rising AI demand.

Finally, the stock briefly topped $1,000 a share the following week, on Feb. 15, after Bank of America initiated coverage with a buy rating, saying the market for AI servers is much larger than Wall Street believes.

However, the following day, the stock came crashing down after Wells Fargo rated the stock “equal weight” and said the high expectations were largely priced in.

Following a brief swoon, the stock skyrocketed on Feb. 22, after Nvidia delivered another blowout earnings report. Then it cooled off for the rest of the month.

Will Supermicro keep gaining?

Supermicro started off March with a bang, jumping 4.5% on March 1, after rival Dell Technologies said it was seeing demand for AI servers jump. After hours on Friday, Supermicro shares soared again when the company gained admission into the S&P 500, a key milestone that acts as a stamp of approval from the broad market index. Its inclusion means that ETFs that track the S&P 500 will have to buy the stock.

Supermicro shares have already tripled this year, but those gains seem warranted, given its strong performance and soaring demand for AI hardware. The stock is likely to remain volatile, given the hype in the AI sector, but it still looks like a good bet to move higher.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Bank of America and Wells Fargo. The Motley Fool has positions in and recommends Bank of America, Goldman Sachs Group, and Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

Why Super Micro Computer Stock Jumped 64% in February was originally published by The Motley Fool