Artificial intelligence is revolutionizing how we manage our finances. From automated budgeting to personalized investment strategies, AI tools are making financial management more accessible, efficient, and effective than ever before. The integration of AI in personal finance isn’t just a trend—it’s reshaping our relationship with money by providing deeper insights, predicting future patterns, and automating routine tasks that once consumed hours of our time.

AI-Driven Budgeting: Beyond Spreadsheets and Manual Tracking

Traditional budgeting methods often fail because they require constant manual input and lack personalization. AI-powered budgeting tools are changing this landscape by automatically categorizing expenses, identifying spending patterns, and providing actionable insights without requiring hours of data entry.

Automated Expense Tracking and Categorization

AI-driven apps like Mint and YNAB (You Need A Budget) have transformed expense tracking by automatically categorizing transactions and providing real-time updates on spending habits. These tools connect to your bank accounts and credit cards, analyzing transaction data to sort expenses into categories like groceries, entertainment, and utilities.

What makes these AI tools particularly powerful is their ability to learn from your spending habits over time. For example, if you regularly visit a local coffee shop, the AI will recognize this pattern and automatically categorize future transactions at that location as “Coffee” or “Dining Out” without requiring manual input.

Predictive Budgeting Using Historical Data

AI doesn’t just track what you’ve already spent—it predicts future expenses based on historical patterns. Tools like PocketGuard analyze your spending history to forecast upcoming bills and expenses, helping you prepare for financial obligations before they arrive.

These predictive capabilities are particularly valuable for managing variable expenses. By analyzing seasonal spending patterns, AI can alert you to potential budget strains during holiday seasons or summer vacations, allowing you to adjust your savings strategy accordingly.

Personalized Spending Insights and Recommendations

Perhaps the most valuable aspect of AI in budgeting is the personalized recommendations it provides. AI tools can identify unnecessary subscriptions, suggest areas where you might be overspending, and recommend adjustments to help you reach your financial goals.

For instance, Cleo, an AI financial assistant, uses conversational AI to provide personalized feedback on your spending habits. It might notice you’ve spent more on dining out this month than usual and suggest ways to balance your budget, or identify a subscription you rarely use and recommend canceling it to save money.

AI in Investing: Democratizing Financial Expertise

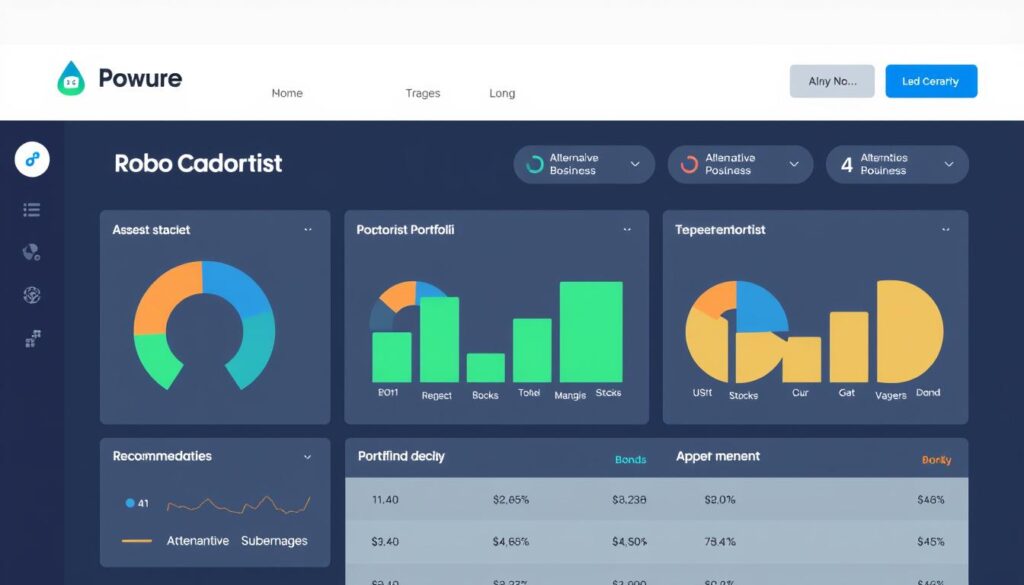

Investment management was once the exclusive domain of financial advisors and those with significant wealth. AI has democratized access to sophisticated investment strategies through robo-advisors, algorithmic trading, and personalized portfolio management.

Robo-Advisors and Automated Portfolio Management

Robo-advisors like Betterment and Wealthfront use AI algorithms to create and manage investment portfolios tailored to your financial goals, risk tolerance, and time horizon. These platforms automatically rebalance your portfolio, reinvest dividends, and implement tax-loss harvesting strategies that were once only available to high-net-worth individuals.

The accessibility of these platforms has dramatically lowered the barrier to entry for investing. With minimum investments as low as $10 in some cases, even those just starting their financial journey can benefit from sophisticated investment strategies.

Risk Assessment and Portfolio Optimization

AI excels at analyzing vast amounts of data to assess risk and optimize investment portfolios. These systems can evaluate thousands of potential investment combinations to identify the optimal asset allocation for your specific goals and risk tolerance.

For example, M1 Finance uses AI to help maintain your desired portfolio allocation through dynamic rebalancing, automatically adjusting your investments to stay aligned with your financial strategy as market conditions change.

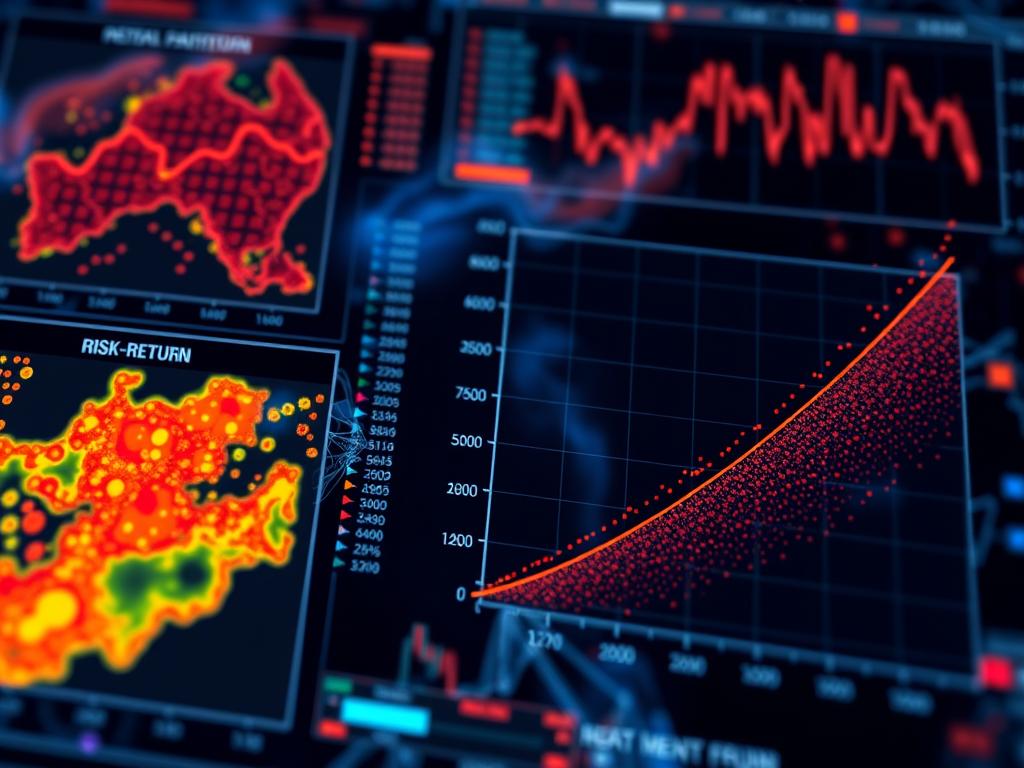

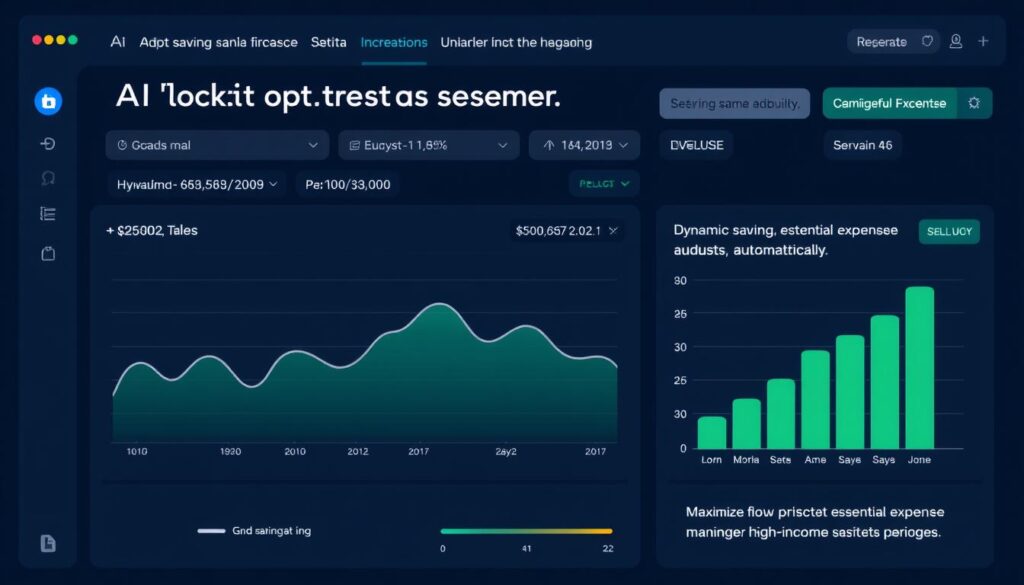

Market Trend Prediction and Analysis

While no system can perfectly predict market movements, AI tools can analyze market trends, news sentiment, and economic indicators to identify potential investment opportunities. Platforms like Kavout use AI to rank stocks based on their potential for future performance, helping investors make more informed decisions.

It’s important to note that while AI can provide valuable insights, it should complement rather than replace human judgment in investment decisions. The most effective approach combines AI’s data processing capabilities with human oversight and strategic thinking.

“AI in investing isn’t about removing human judgment—it’s about enhancing it with data-driven insights that humans alone couldn’t process.”

Smart Saving with AI: Automating Your Path to Financial Goals

Saving money consistently is one of the biggest challenges in personal finance. AI tools are making this essential habit easier by automating savings, optimizing interest rates, and adapting to your changing financial situation.

Automated Savings Apps and Intelligent Fund Allocation

Apps like Digit and Chime analyze your income, spending patterns, and account balances to automatically transfer small amounts of money to savings. These micro-savings add up over time without requiring conscious effort or significant lifestyle changes.

What makes these tools particularly effective is their ability to adjust savings amounts based on your current financial situation. If your account balance is lower than usual or a large expense is coming up, the AI will reduce or pause savings to prevent overdrafts.

AI-Powered Goal Setting and Progress Tracking

Setting financial goals is one thing—staying motivated to achieve them is another. AI tools help bridge this gap by breaking down large financial goals into manageable steps and providing regular progress updates.

For example, Qapital uses AI to help you set rules for saving based on your spending habits and financial goals. You might create a rule to round up every purchase to the nearest dollar and save the difference, or automatically save a percentage of your income whenever you receive a paycheck.

Dynamic Savings Strategies Based on Income Fluctuations

For those with variable income, such as freelancers or commission-based workers, consistent saving can be particularly challenging. AI tools can adapt to income fluctuations, adjusting savings rates during high-income periods and reducing them during leaner times.

Albert, an AI-powered financial app, analyzes your income patterns and bills to identify “safe to save” amounts that won’t impact your ability to cover essential expenses. During months with higher income, it automatically increases your savings rate to compensate for potential future shortfalls.

Challenges and Future Outlook of AI in Personal Finance

While AI offers tremendous benefits for personal finance management, it also presents challenges that users should be aware of. Understanding these limitations is essential for using AI tools effectively while maintaining control of your financial future.

Benefits of AI in Personal Finance

- Automated tracking saves time and reduces human error

- Personalized insights based on individual financial patterns

- Accessible financial expertise for all income levels

- Continuous learning and improvement over time

- Emotion-free decision making based on data

Challenges of AI in Personal Finance

- Data privacy and security concerns

- Potential for algorithmic bias in recommendations

- Over-reliance on automation without human oversight

- Limited understanding of unique personal circumstances

- Varying quality and accuracy across different AI tools

Future Trends in AI-Powered Financial Management

The future of AI in personal finance looks promising, with several emerging trends poised to further transform how we manage money:

- Hyper-personalization: AI will provide increasingly tailored financial advice based on a comprehensive understanding of your financial situation, goals, and values.

- Integration with blockchain: Combining AI with blockchain technology will enhance security while enabling more sophisticated financial products and services.

- Voice-activated financial management: AI assistants will allow for conversational financial planning and real-time advice through voice interfaces.

- Predictive financial wellness: AI will move beyond reactive analysis to proactively identify potential financial issues before they occur.

Conclusion: Embracing AI for Financial Empowerment

AI in personal finance represents a significant shift in how we manage money—from reactive tracking to proactive planning and optimization. By automating routine tasks, providing personalized insights, and offering sophisticated financial strategies once reserved for the wealthy, AI tools are democratizing financial expertise and empowering individuals to take control of their financial future.

While these tools offer tremendous benefits, they work best when combined with human judgment and a basic understanding of financial principles. The most successful approach is to leverage AI’s computational power and pattern recognition capabilities while maintaining oversight of your overall financial strategy.

As AI technology continues to evolve, the potential for more sophisticated, secure, and personalized financial management tools will only increase. By embracing these innovations while maintaining a thoughtful approach to your finances, you can harness the power of AI to build a more secure and prosperous financial future.

Take Your AI Financial Management to the Next Level

Download our free guide “The Ultimate AI Finance Toolkit” to discover the top 10 AI tools for budgeting, investing, and saving, complete with step-by-step implementation strategies and privacy protection tips.