According to projections from Grand View Research, the artificial intelligence (AI) market will grow at a compound annual rate of 37% through 2030. That trajectory would see the sector hit an annual market value of nearly $2 trillion by the end of the decade. With growth like that on the horizon, it would be smart to dedicate a portion of your portfolio to companies that can capitalize on this budding industry.

The launch of OpenAI’s ChatGPT in November 2022 reinvigorated interest in AI and highlighted just how far the technology had come. AI can bolster countless industries, among them healthcare, consumer tech, productivity software, cloud computing, and autonomous vehicles.

However, it’ll take time for AI to expand its reach and for companies to fully exploit its potential. While that process continues, here are two exciting AI stocks you can buy and hold for the next decade.

1. Nvidia

The boom in AI last year cast a bright spotlight on Nvidia‘s (NASDAQ: NVDA) business as its cutting-edge chips became the preferred hardware for AI developers and cloud infrastructure providers everywhere.

Its years of dominance in graphics processing units (GPUs), the chips necessary for training AI models, positioned it to immediately begin supplying hardware to countless AI-minded firms as the market exploded. Nvidia got a head start over rivals like AMD and Intel and snapped up an estimated 80% to 95% market share in AI GPUs.

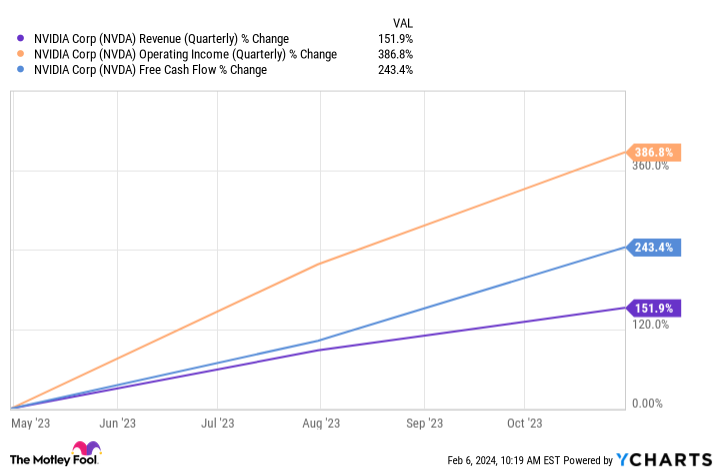

Soaring chip sales have sent Nvidia’s revenues, operating income, and free cash flow skyrocketing over the last year, propelling its stock up over 215%. The company’s free cash flow hit more than $17 billion, significantly higher than AMD’s just over $1 billion and Intel’s negative $14 billion.

So, despite new GPU releases from both of those rival chipmakers, Nvidia’s early advantages in AI have potentially pushed it further ahead, with greater cash reserves to continue investing in its technology and retain its market supremacy.

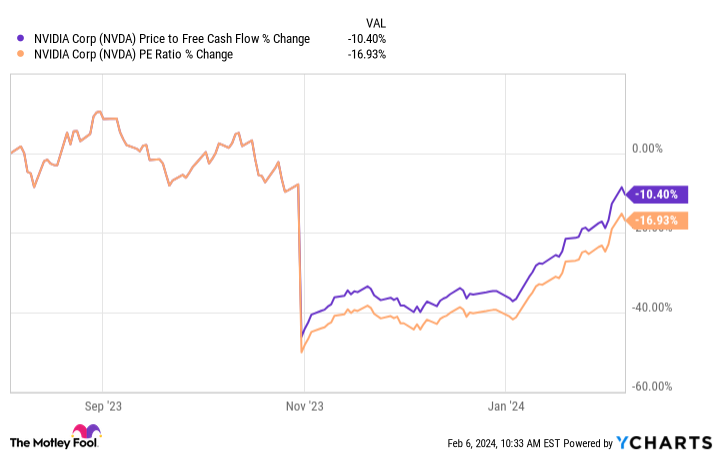

Nvidia’s price-to-free-cash-flow ratio and price-to-earnings ratio have declined by double-digit percentages in the last six months. And when it comes to these metrics, the lower the figure, the better the value.

As a result, now is an excellent time to make a long-term investment in Nvidia that will allow you to benefit from consistently rising demand for its AI GPUs.

2. Amazon

Shares of Amazon (NASDAQ: AMZN) are up 65% since last February, in part due to its significant financial growth and exciting prospects in AI.

The company posted its fourth-quarter results last week. Revenue rose 14% year over year to $170 billion, beating Wall Street estimates by nearly $4 billion. Meanwhile, its earnings per share hit $1.00, compared to the expected $0.80.

Over the last 12 months, impressive growth has sent Amazon’s free cash flow soaring by 904% to $32 billion.

The tech giant’s e-commerce business has also returned solidly to growth. However, the best reason to invest in its stock is its highly profitable cloud platform, Amazon Web Services (AWS). As the world’s leading cloud infrastructure provider, it has the potential to leverage its massive data centers and steer the generative AI market in its favor.

Over the last year, AWS has responded to the rising demand for AI services by expanding its offerings. For instance, in September, the company debuted Bedrock, a tool that offers a range of models that customers can use to build generative AI applications. AWS also introduced CodeWhisperer, a platform that generates code for developers, and HealthScribe, a tool capable of transcribing patient-to-physician conversations.

In fiscal 2023, AWS accounted for 67% of Amazon’s operating income despite delivering the lowest revenue of its three segments. As it continues to expand its AI services, Amazon could be in for consistent earnings boosts long into the future.

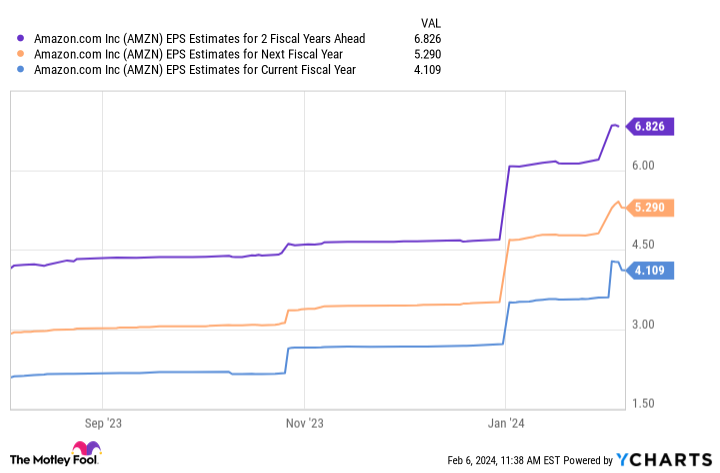

Based on current estimates, Amazon’s earnings could hit just under $7 per share in two fiscal years. Multiplying that figure by its forward P/E of 41 yields a stock price of $279. So if projections are correct and the forward ratio stays the same, Amazon’s stock will rise 65% by fiscal 2026.

All of this makes Amazon one of the best AI stocks to buy now and hold for the next decade and beyond.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.