Cadence Design Systems

(NASDAQ: CDNS)

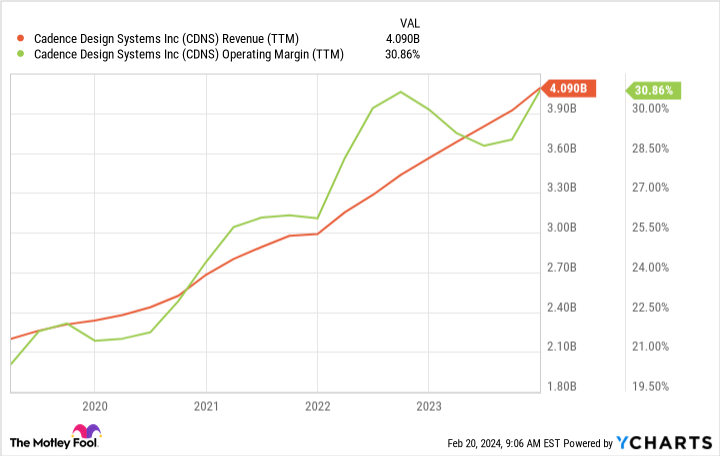

— a leader in semiconductor and computing system design software — has been thriving. Over the past 12 months, shares have surged by nearly 60%, with a more than 12% increase in 2024. Its latest venture involves leveraging artificial intelligence (AI).

In early February, Cadence introduced a new supercomputer system named Millennium M1 that utilizes graphics processing units (GPUs) from top providers, potentially including Nvidia, a prominent player in GPU systems and a longtime partner of Cadence.

Cadence’s announcement aligns with a broader trend in chip design, with AI playing a pivotal role in driving growth. Can Cadence sustain its impressive performance?

Cadence and its CFD Positioning

The Millennium M1 AI supercomputer serves as a server, a substantial computing unit deployable on-site in a company’s premises or in the cloud for remote access. Cadence specifically designed this computing platform to accelerate computational fluid dynamics (CFD).

CFD is a form of analytics and simulation software utilized in designing various systems such as car engines, aircraft engines, and industrial processes involving fluids and materials. Essentially, any “flowing” phenomenon can be analyzed and simulated using CFD.

Cadence’s Millennium Platform, powered by the Millennium M1, represents the initial CFD and multi-physics simulation product leveraging a purpose-built supercomputer for intricate computations. It functions as an enhanced “digital twin” platform, enabling engineering teams to preview a product or project’s behavior in real-world conditions before manufacturing or construction.

Nvidia CEO Jensen Huang has emphasized the enormous potential of digital twins, particularly during the past metaverse trend. However, CFD and multi-physics simulation present significant potential in the business realm.

Cadence has been preparing for this, hinting at substantial developments in CFD during a big Nvidia product release event a year ago.

Notably, these significant advancements in CFD, representing a convergence of the digital and physical worlds, are the reason why Cadence’s competitor Synopsys is acquiring simulation software provider Ansys, and why hardware testing company Keysight Technologies completed a simulation software acquisition last year.

Does Cadence Hold a Unique Advantage?

Could Millennium provide Cadence with a competitive edge? Certainly. Cadence and Synopsys dominate the semiconductor design software landscape (known as EDA or electronic design automation), benefiting from the influx of new devices incorporating chips.

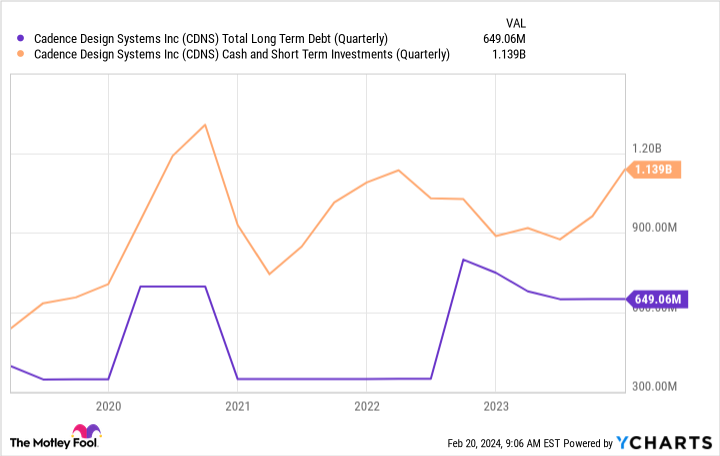

However, Synopsys’ move with Ansys implies significant debt repayment if the deal finalizes (potentially in 2025). Alternatively, Cadence is developing integrated services combining chip design with mechanical processes internally. In essence, its solid financial position and leading profit margins will remain intact, while Synopsys will need to absorb its acquisition (if it proceeds).

Following a stellar 2023 marked by soaring profitability, Cadence’s stock is trading at a premium, with a valuation close to 50 times the projected earnings for 2024. Despite this, innovations like its new AI supercomputer, supported by GPUs and advanced hardware and software algorithms, position Cadence as a premium stock for valid reasons. In 2024, exercising patience with this investment and considering a dollar-cost averaging strategy may align with your portfolio objectives if long-term ownership of Cadence Design Systems is part of your plans.

Should you invest $1,000 in Cadence Design Systems right now?

Before investing in Cadence Design Systems, take into account the insights below:

The Motley Fool Stock Advisor analyst team recently pinpointed what they perceive as the 10 best stocks to buy now… and Cadence Design Systems did not make the list. The 10 stocks highlighted are poised to generate substantial returns in the coming years.

Stock Advisor equips investors with a straightforward blueprint for success, providing portfolio-building guidance, regular analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has surpassed the S&P 500 returns by more than threefold*.

*Stock Advisor returns as of February 20, 2024

Nick Rossolillo holds positions in Cadence Design Systems, Nvidia, and Synopsys. The Motley Fool holds positions in and recommends Cadence Design Systems, Nvidia, and Synopsys. The Motley Fool endorses Ansys. The Motley Fool maintains a disclosure policy.

1 Hot Stock for 2024 With a Potential Nvidia AI Partnership was originally published by The Motley Fool

1-hot-stock-for-2024-with-a-potential-nvidia-ai-partnership