Artificial intelligence (AI) is revolutionizing nearly every sector, attracting significant interest from investors. To sift through the hype and identify companies with long-term potential, it’s crucial to conduct thorough analysis akin to evaluating any stock. Consider factors like the company’s current performance, challenges, opportunities, management credibility, and valuation.

Pagaya Technologies (NASDAQ: PGY) is an AI stock that has yet to garner widespread attention, but analysts anticipate substantial growth potential. Is it a smart investment right now?

Transforming Traditional Credit Assessment

Pagaya operates an AI-driven credit assessment platform capable of analyzing vast amounts of data to provide a more precise borrower credit profile than conventional credit scoring methods.

With a dual business approach, Pagaya collaborates with banks and lenders to identify viable loan opportunities while minimizing default risks. It further packages the loans into asset-backed securities (ABS) sold to institutional investors.

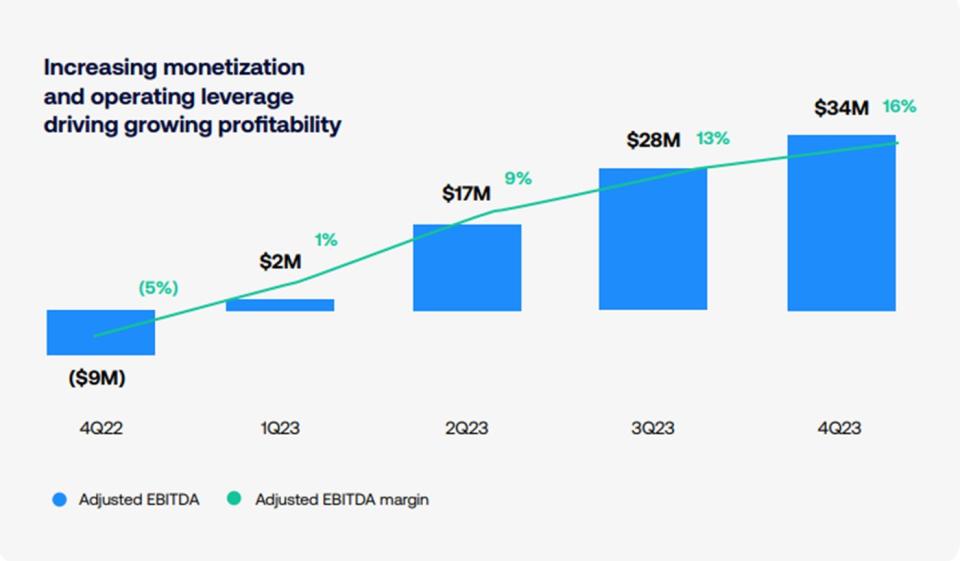

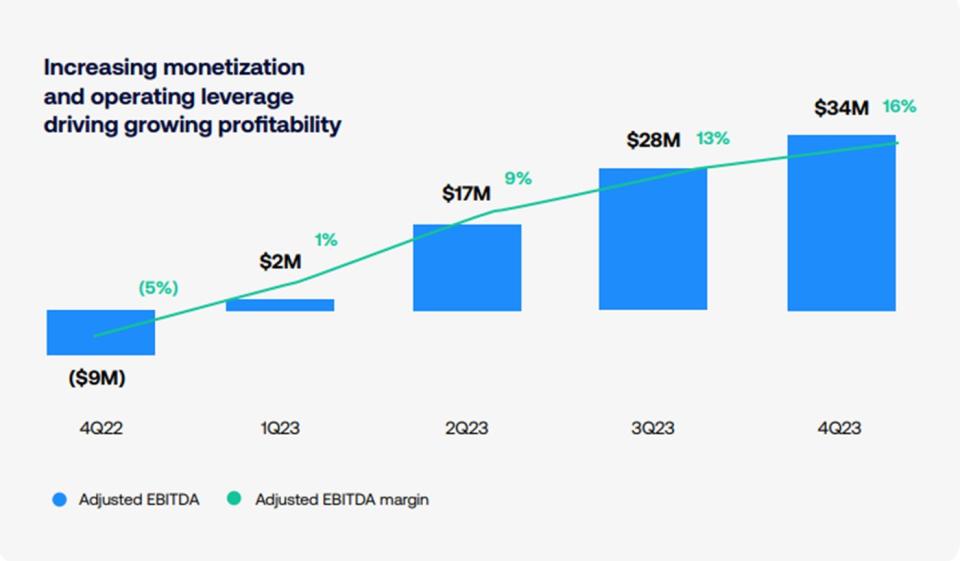

Despite current high-interest rates affecting its performance, Pagaya’s recent financial results are commendable. Let’s dissect the 2023 fourth-quarter and full-year figures:

Period | Network volume growth | Revenue growth | FRLPC change | Adjusted EBITDA | Net income |

|---|---|---|---|---|---|

Fourth quarter | 33% | 13% | 42% | $34 m +$43 m from last year | ($14 m) +$20 m from last year |

Full year | 14% | 8% | 13% | $82 m +$87 m from last year | ($128 m) +$186 m from last year |

Source: Pagaya quarterly results. FRLPC = revenue from fees less production costs. EBITDA = earnings before interest, taxes, depreciation, and amortization. All growth figures are year over year.

Management anticipates a 20% increase in network volume, 23% revenue growth, and more than doubling of adjusted EBITDA in 2024.

Exploring Lucrative Opportunities

Pagaya aims to introduce its platform to various creditors, including banks, auto lenders, and credit card networks. It has established partnerships with well-known entities such as Visa, Ally Bank, and SoFi Technologies.

Notably, Pagaya recently disclosed a collaboration with Westlake Financial, a major auto loan provider. This venture is set to expand to encompass all branches by 2025, with plans for a model tailored to new car sales.

Furthermore, Pagaya announced U.S. Bank as its new prominent banking partner, signaling potential for future growth.

Pagaya holds a dominant position in issuing ABS loans in the U.S., raising significant capital in recent years. The company has already secured substantial credit facilities in 2024, reflecting strong investor confidence.

Addressing Challenges and Risks

While Pagaya exhibits promising growth, it remains relatively young and lacks an extensive track record to demonstrate stability. The company is moving toward profitability but has yet to achieve net profitability or positive cash flow.

Notably, Pagaya witnessed a decline in core operating expenses and reported positive operating income and cash flow in recent quarters. Management projects achieving a positive cash flow position in early 2025.

Assessing Valuation and Potential

Despite a 46% increase in the past year, Pagaya stock currently trades at a price-to-sales ratio of 1.4, representing an attractive valuation for a high-growth stock.

Analysts project a target price range of $3 to $6 for Pagaya stock, indicating substantial potential for future gains.

While Pagaya presents an appealing growth opportunity, it comes with inherent risks typical for early-stage companies in a volatile industry.

Before investing $1,000 in Pagaya Technologies, carefully consider:

The Motley Fool Stock Advisor team recently highlighted the 10 best stocks poised for substantial returns, with Pagaya Technologies not included in the list. The recommended stocks could potentially deliver impressive gains in the foreseeable future.

Stock Advisor offers a comprehensive investment strategy, featuring expert guidance on portfolio construction, regular analyst updates, and bi-monthly stock picks that have significantly outperformed the S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Ally is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has positions in and recommends JPMorgan Chase and Visa. The Motley Fool recommends Pagaya Technologies. The Motley Fool has a disclosure policy.

Wall Street Sees 100% Upside for This Artificial Intelligence (AI) Stock No One Is Talking About was originally published by The Motley Fool

wall-street-sees-100-upside-for-this-artificial-intelligence-ai-stock-no-one-is-talking-about