When it comes to artificial intelligence (AI), while it is commonly viewed as a software program, it also relies on hardware for development and operation. This has prompted investors to seek out “pick-and-shovel” style investments, where companies provide the necessary tools for these processes, similar to how businesses sold picks and shovels to gold miners during the various gold rushes in U.S. history.

Two prominent “pick-and-shovel” plays in the AI market are Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI). Both stocks have seen significant growth since the beginning of 2023, with Nvidia and Super Micro Computer’s stocks surging by 437% and 1,000%, respectively.

But which of these companies is the better investment at this point? Let’s analyze.

Nvidia and Super Micro Computer: Complementary Businesses

While both companies can be considered “pick-and-shovel” investments, Nvidia primarily manufactures the tools necessary for AI, such as graphics processing units (GPUs) to handle the complex workloads required by AI models. Supermicro, on the other hand, assembles these tools into servers and sells them to end users.

When companies need to build a supercomputer to leverage the power of data through AI, they require not just one or two GPUs, but hundreds or even thousands. These GPUs must be strategically placed and connected to servers, which is where Supermicro’s expertise comes into play.

Supermicro constructs servers for clients and offers customizable models tailored to specific end-use and computing power requirements. They collaborate closely with Nvidia to maximize the performance of these servers, delivering long-term benefits to users.

But when it comes to deciding which company to invest in, the choice is clear.

Nvidia Takes the Lead in Investment Value

Supermicro heavily relies on Nvidia for its business. If Nvidia prioritizes fulfilling GPU orders for other clients or if their relationship deteriorates, Supermicro’s business could suffer greatly. While the partnership between these two companies has been solid, this is still a factor to consider.

Additionally, Supermicro faces tough competition from other server builders like Hewlett-Packard and IBM, while Nvidia’s AI GPUs stand out in their own league.

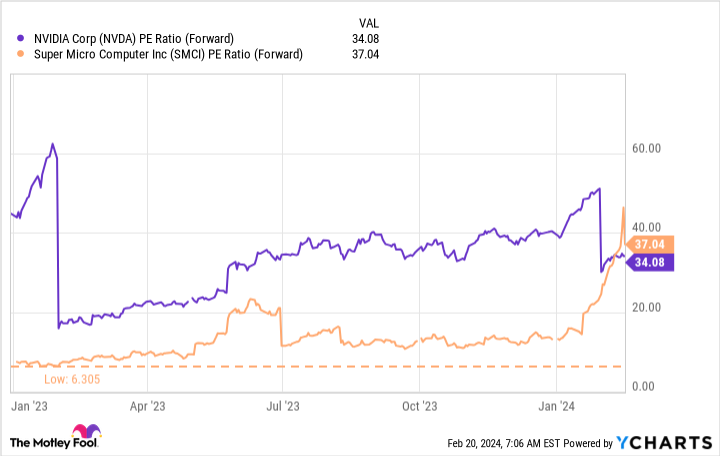

Given these factors, the preference leans heavily towards Nvidia. Moreover, both stocks were undervalued at the beginning of 2023, but Supermicro’s stock was exceptionally affordable at just over six times forward earnings.

Despite Supermicro outperforming Nvidia’s stock over the past year, this trend is likely to change soon. With Supermicro now pricier than Nvidia, it doesn’t make much sense to invest in it, especially if both companies are growing at a similar pace.

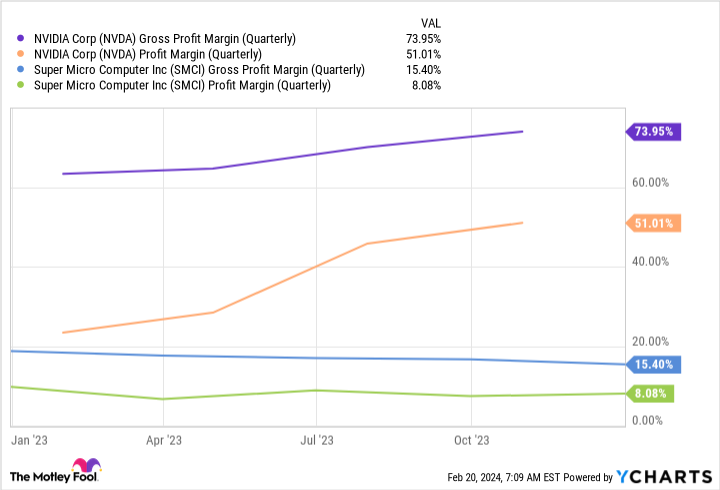

Nvidia’s business model holds a significant advantage as it controls the main product, leading to higher profit margins assessment.

Nvidia boasts higher profitability compared to Supermicro. When faced with a choice between two evenly priced stocks growing at similar rates, opting for the more profitable one is the logical decision.

While both companies are poised for success as the AI industry continues to expand, Nvidia stands out due to its superior margins and product control. Super Micro Computer may be a solid investment option, but it’s advisable to go with Nvidia given the current scenario.

Should you invest $1,000 in Nvidia right now?

Before considering an investment in Nvidia, take note:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy now, and Nvidia isn’t among them. These 10 stocks are projected to deliver substantial returns in the upcoming years.

Stock Advisor offers investors a straightforward blueprint for success, including portfolio building guidance, analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has outperformed the S&P 500 by more than triple*.

*Stock Advisor returns as of February 20, 2024

Keithen Drury holds no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

Better AI Stock: Nvidia or Super Micro Computer? was originally published by The Motley Fool

better-ai-stock-nvidia-or-super-micro-computer